Election jitters are affecting construction activity, though public sector projects continue moving ahead, at least for now.

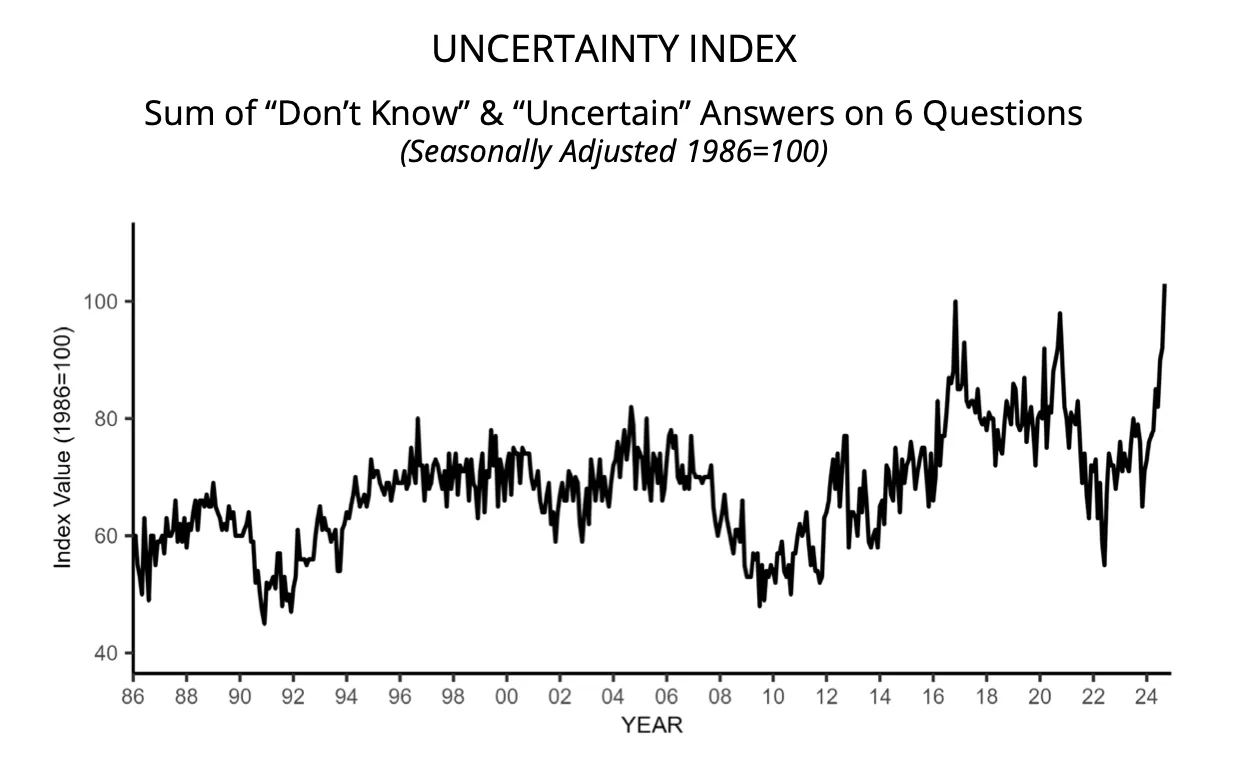

Uncertainty among small business owners across all industries recently reached an all-time high, according to the latest index from the National Federation of Independent Business, a trade group representing smaller companies. This anxiety, coming during one of the tightest presidential contests in recent memory, is affecting overall building activity, industry pros told Construction Dive.

Courtesy of National Federation of Independent Business

“We are noticing uncertainty in the market around the possible economic impacts of the election,” said Granger Hassmann, vice president of preconstruction and estimating at Adolfson & Peterson, a Minneapolis-based construction management firm. “The market in general seems to have slowed down, especially in the private sector.”

And while the degree of uncertainty has increased in recent months, Hassmann added that the trend has been apparent for the last two years, with the slowdown exacerbated by a “let’s see what happens attitude,” he said.

Granger Hassmann

Courtesy of Adolfson & Peterson

Meanwhile, in the Fed’s latest Beige Book report, which provides commentary on current economic conditions, the Federal Reserve Bank of Cleveland noted that two unnamed commercial builders recently reported that many companies plan to wait until after the general election to undertake construction projects. Construction firms in New York also reported that activity there has declined at a moderate pace, according to the Federal Reserve Bank of New York.

Harbingers of construction

Architectural firms, often early indicators of future construction activity, have also noted a slowdown. Design companies have been feeling this pinch as the upcoming election clouds anticipated economic recovery, said Kermit Baker, chief economist at The American Institute of Architects.

“We expected with inflation concerns receding and interest rates easing, that a recovery would be coming but it seems that election uncertainty is inhibiting any expected recovery at the moment,” said Baker. “[Architecture] firms pointed to the upcoming elections as a major reason for the expected weakness in the second half of the year.”

Kermit Baker

Permission granted by AIA

That hesitation can be seen in other areas, as well.

For example, electric vehicle battery manufacturer Ultium Cells recently paused its $2.6 billion factory in Lansing, Michigan, due to sluggish demand and high interest rates. The company plans to resume the project once it has a clearer economic outlook, reflecting the broader wait-and-see strategy referred to by Hassmann.

And in Philadelphia, real estate developer Shift Capital paused conversion work in August on the historic Beury Building due to lender financing issues, with CEO Brian Murray noting that high interest rates and lender caution have made banks wary of committing to large projects. That hesitation reflects broader concerns around the economic environment, including high interest rates and regulatory uncertainties.

That lack of clarity is fueling this cautious approach, as various potential outcomes could create different policy environments, said Michael Guckes, chief economist at ConstructConnect, a Cincinnati-based construction data provider.

Real estate developer Shift Capital paused work in August on the Beury Building in Philadelphia due to lender financing issues.

Courtesy of Shift Capital

“This matter, in general, is tricky because so much depends on who controls not just the White House but also Congress,” said Guckes. “There are many ‘divided government’ scenarios which would see either candidate’s presidential plans generally thwarted by an opposing Congress.”

Public projects faring better

An exception seems to be infrastructure projects and public sector work.

Most public construction projects have a long lead time and create structures that are intended to be used for many years, so many owners would likely not hold off after getting designs, approvals and financing, said Ken Simonson, chief economist at the Associated General Contractors of America. AGC member firms haven’t reported uncertainty from the election as a reason for owners to hold off on public jobs, he said.

Ken Simonson

Courtesy of AGC

“I think public projects, [such as] infrastructure, schools, public safety, judicial, penal structures, data centers, utility projects and many manufacturing plants are especially immune to election uncertainty,” said Simonson. “These happen to be the categories with the best prospects for 2025.”

Nevertheless, some funding packages, such as massive subsidies to manufacturers willing to invest in new domestic production capacity and alternative energy producers included in the CHIPS Act and Inflation Reduction Act, could be substantially reshaped by a change in administration, said Anirban Basu, chief economist at Associated Builders and Contractors.

“This appears especially true in the energy sector,” said Basu. “Under one possible scenario, subsidies to alternative energy producers would be diminished, while support for more traditional forms of energy would be more supported.”

For example, solar cell manufacturer Meyer Burger recently shelved its $400 million plant project in Colorado due to financial constraints tied to the Inflation Reduction Act and an uncertain economic environment. That reduced its potential debt financing and, consequently, its construction funds.

Anirban Basu

Permission granted by ABC

Basu also noted broader economic trends impacting contractors.

For instance, although the cost of construction materials is 39% higher than at the onset of the COVID-19 pandemic, prices have been steadier over the past two years. Recent declines in energy prices have helped maintain this trend, but Basu warned that a potential renewal of trade warfare, especially involving tariffs on China, would likely result in higher construction costs.

He added that trade-related inflationary pressures could place upward pressure on interest rates, something contractors have been eager to see ease.

A return to high rates?

If one party gains full control of the White House and Congress, the impact on construction would be more substantial, said Guckes.

A Trump presidency with a Republican sweep of Congress could lead to heightened deficit spending, lower corporate taxes and increased tariffs. That would create a mixed-environment of near-term growth with a potential second wave of inflation, said Guckes.

Assuming the Federal Reserve resorts to its inflation-battling strategy of 2022 and 2023, higher interest rates would be employed once again to curb that inflation. These hikes would then profoundly impact the ability of owners and developers to finance new construction again, said Guckes.

Michael Guckes

Courtesy of ConstructConnect

“A repeat of the 2022 interest rate hikes in 2026 or 2027 would negatively impact construction in the year or years to follow as was the case in 2023 and 2024,” said Guckes. “ConstructConnect’s current expectation for 4% annualized construction growth in both 2027 and 2028 would be at risk of significant downward revisions.”

Stricter regulations?

By contrast, a Harris administration with Democratic control of Congress would likely avoid aggressive near-term spending but could impose stricter environmental and labor regulations. That could potentially slow construction activity too, said Guckes.

“We would expect a [Harris administration to have a] less aggressive approach to bolstering near-term growth. This would allow the country to avoid the worst of the inflation concerns,” said Guckes. “Heightened environmental and labor regulations could slow the pace of new construction while also increasing costs.”

In either scenario, Guckes suggested that the industry will soon have clarity to resume or revise plans based on the ultimate outcome after Election Day.